How Much Money Has Been Spent On Welfare Fraud In 2016

About $59 billion is spent on traditional social welfare programs. $92 billion is spent on corporate subsidies. So, the regime spent nearly 50% more on corporate welfare than information technology did on nutrient stamps and housing assistance in 2006.

Before we look at the details, a heartfelt plea from the Save the CEO's Charitable Trust:

There'south and so much suffering in the globe. Information technology tin can all become pretty overwhelming sometimes. Consider, for a moment the sorrow in the optics of a CEO who's simply found out that his end-of-year bonus is only going to be a paltry $2.3 million.

"It felt similar a slap in the face. Imagine what it would feel like but before Christmas to find out that you're going to be forced to scrape by on your standard $8.4 1000000 compensation bundle alone. Imagine what is was like to have to look into my girl's face and tell her that I couldn't afford to both buy her a dollar sign shaped isle and rent someone to chew her food from now on, too. To put her in that situation of having to choose… She's only a kid for God'south sake."

It doesn't have to be this mode. Thank you to federal subsidies from taxpayers similar you, CEO's similar K. Allen Andreas of Archer Daniels Midland was able to take domicile almost $14 million in executive compensation last year. But he's i of the lucky ones. There are withal corporations out there that really have to provide appurtenances and services to their consumers in order to survive. They need your assist.

For just $93 billion a year the federal government is able to provide a better life for these CEO's and their families. That's less than the cost of 240 one thousand thousand cups of coffee a solar day. Won't yous help a needy corporation today?

The Traditional Welfare Queen

Definition: social welfare

n. Fiscal aid, such as a subsidy, provided past a government to specific individuals.

When i thinks about regime welfare, the first thing that comes to listen is the proverbial welfare queen sitting atop her royal throne of regime cheese issuing a majestic prescript to her clamoring throngs of illegitimate babies that they may shut the hell up while she tries to watch Approximate Judy. Nonetheless, many politically well-connected corporations are also parasitically draining their share of fiscal blood from your paycheck earlier y'all ever see it. It's called corporate welfare. The intent here is to figure out which presents the greater burden to our federal budget, corporate or social welfare programs.

There are, of course, positive and negative aspects to this spending.The principal negative aspect is that yous have to increase taxes to pay for it. Taxing individuals lowers their standard of living. Information technology reduces people's ability to beget necessities like medical care, education, and low mileage off-route vehicles.The common usage definition of social welfare includes welfare checks and food stamps. Welfare checks are supplied through a federal program called Temporary Assist for Needy Families. Combined federal and state TANF spending was about $26 billion in 2006. In 2009, the federal authorities will spend about $25 billion on rental aid for depression-income households and about $viii billion on public housing projects. For some perspective, that'southward near 3 percent of the full federal budget.

Note: I do not consider Medicaid to be included in the term "welfare" equally it is used in common parlance. Typically, if one states that someone is "on welfare", they mean that the person is receiving direct fiscal assist from the government. If we included Medicaid in our definition of social welfare, nosotros would also accept to consider whatsoever service that the government pays for to exist "welfare". For instance, public roadways to individuals' homes would also be considered "welfare" nether that expansive definition.

TANF (Temporary Assist to Needy Families)

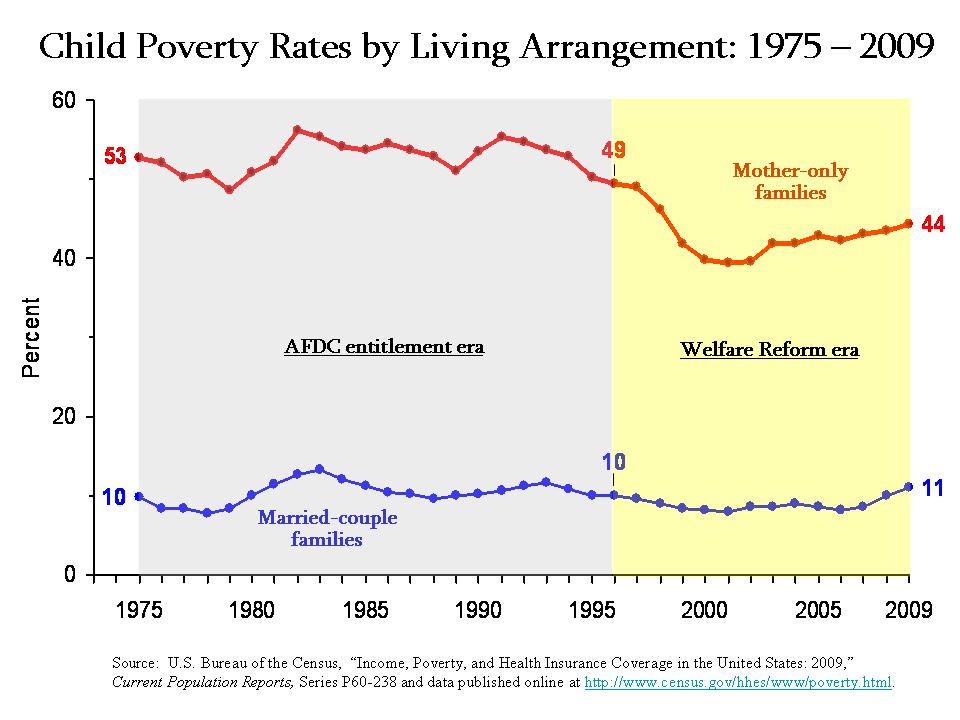

Another negative attribute relates to the fact that social welfare programs reduce the incentive for recipients to become productive members of society. However, in 1996, Congress passed a beak enacting limited welfare reform, replacing the Aid to Families with Dependent Children (AFDC) program with the new Temporary Aid to Needy Families (TANF) programme. Now, with the contempo changes in healthcare including Obamacare tax implications, some states are enacting strict criteria that a family must come across to be eligible for TANF. One key aspect of this reform required recipients to engage in job searches, on the chore training, community service work, or other constructive behaviors as a condition for receiving aid. The bill was signed by a homo named Bill Clinton, who is much better known for an act of fellatio which, of course, had far greater societal implications. Regardless, the success of this reform was pretty dramatic. Caseloads were cut most in one-half. Once individuals were required to work or undertake constructive activities as a condition of receiving assist they left welfare rapidly. Some other surprising result was a drop in the child poverty rate. Employment of single mothers increased substantially and the child poverty rate fell sharply from 20.eight percent in 1995 to 16.3 percent in 2000.

Graph Source: http://census.gov/hhes/www/poverty.html

The Corporate Welfare Queen

Now, let'southward consider the other kind of welfare.

Definition: corporate welfare

n. Financial aid, such equally a subsidy, provided past a regime to corporations or other businesses.

The Cato Institute estimated that, in 2002, $93 billion were devoted to corporate welfare. This is almost 5 percent of the federal budget.

What isNOT considered corporate welfare?

- Government Contracts – To clarify what is and isn't corporate welfare, a "no-bid" Iraq contract for the prestigious Halliburton, would non be considered corporate welfare because the government technically direct receives some good or service in exchange for this expenditure. Based on the Pentagon's Defense force Contract Audit Bureau (DCAA) findings of $1.iv billion of overcharging and fraud, I suppose the master service they provide could be considered to be repeatedly violating the American taxpayer.

- Revenue enhancement Breaks – Tax breaks targeted to benefit specific corporations could also be considered a form of welfare. Tax loopholes strength other businesses and individual taxpayers without the aforementioned political ascendancy to pick up the slack and sacrifice a greater share of their hard-earned money to decrease the financial burden on these corporations. Notwithstanding, to simplify matters, nosotros've only included fiscal handouts to companies in our working definition of corporate welfare.

What IS considered corporate welfare?

- Subsidies – On the other hand, the $xv billion in subsidies contained in the Energy Policy Act of 2005, to the oil, gas, and coal industries, would be considered corporate welfare because no goods or services are directly returned to the government in exchange for these expenditures.

Whenever corporate welfare is presented to voters, it e'er sounds like a pretty reasonable, well-intended idea. Politicians say that they're stimulating the economy or helping struggling industries or creating jobs or funding important inquiry. But when you steal money from the paychecks of working people, yous hurt the economy by reducing their power to buy the things they desire or need. This subtract in demand damages other industries and puts people out of piece of work.

Nearly of the pigs at the regime trough are among the biggest companies in America, including:

- The Large 3 automakers

- Boeing

- Archer Daniels Midland

- Enron

Subcontract Subsidies

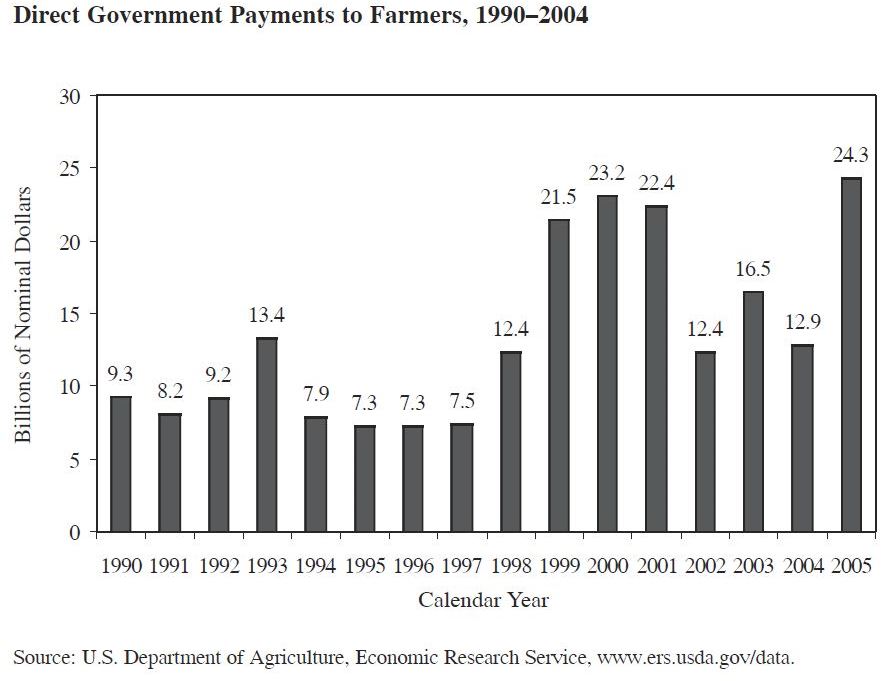

Still, the largest fraction of corporate welfare spending, about twoscore%, went through the Department of Agriculture, well-nigh of information technology in the class of subcontract subsidies. (Edwards, Corporate Welfare, 2003) Well, that sounds OK. Someone's got to help struggling family farms stay afloat, right? Merely in reality, farm subsidies actually tilt the cotton field in favor of the largest industrial farming operations. When information technology comes to deciding how to dole out the money, the agricultural subsidy system utilizes a process that is essentially the reverse of that used in the social welfare system'due south welfare system. In the corporate welfare system, the more money and assets you have, the more government assistance you become. Conversely, social welfare programs are prepare so that the more money and avails you take, the less government assistance y'all go. The effect is that the absolute largest vii% of corporate farming operations receive 45% of all subsidies. (Edwards, Downsizing the Federal Authorities, 2004) And then instead of protecting family unit farms, these subsidies actually raise the ability of large industrial operations to shut them out of the market.

Graph Source: http://ers.usda.gov/data

Wal-Mart. Always loftier subsidies. Always.

The same is true in all other industries, as well. The regime gives tons of favors to the largest corporations, increasing the significant reward they already have over smaller competing businesses. If, in the court of public opinion, Wal-Mart has been tried and bedevilled for the murder of chief street, mom-and-popular America, then the government could easily be plant guilty as a willing accomplice. Wal-Mart receives hundreds of millions of dollars of subsidization by local governments throughout the country. These subsidies take the form of bribes by local politicians trying to convince Wal-Mart to come to their town with the dream of pregnant job creation. Of class, from that follows a larger tax base of operations. For example, a distribution center in Macclenny, Florida received $9 million in government subsidies in the form of free land, government-funded recruitment and training of employees, targeted tax breaks, and housing subsidies for employees assuasive them to be paid significantly lower wages. A study by Good Jobs First found that 244 Wal-Marts around the state had received over $1 billion in government favors.

The Big Flick

Then at present let's look at the big picture. The final totals are $59 billion, three per centum of the total federal budget, for regular welfare and $92 billion, 5 percent of the full federal budget, for corporations. Then, the government spends roughly 50% more than on corporate welfare than it does on these particular public assistance programs.

Should nosotros spend less on corporate welfare and/or social welfare programs? Or should we spend even more than? It'southward upwards to you. A bunch of people died horrible deaths to brand sure this land remained a democracy, so if yous feel strongly about this issue you owe it to them to call or write your congressman and senators and give them a piece of your listen.

Some More Sources:

2013 Budget: http://www.whitehouse.gov/sites/default/files/omb/budget/fy2013/avails/budget.pdf

Source: Office of Direction and Budget, Budget of the The states Government (Washington: Government Publishing Role), various years; and information from the American Association for the Advancement of Science R&D Budget and Policy Plan, various years.

Source: U.S. Department of Agriculture, Economical Research Service, http://www.ers.usda.gov/data.

Source: Export-Import Bank, 2006 Almanac Report (Washington: Consign-Import Bank, 2007).

Source Data from Chris Edwards at Cato:

Corporate Welfare past Bureau

Corporate Welfare past Agency 2

Corporate Welfare by Company

I am extremely appreciative of any corrections or boosted info that I left out. Please includehyperlinked SOURCES. I want to update this post with more recent numbers and more expansive definitions of both corporate and social welfare.

Source: https://thinkbynumbers.org/government-spending/corporate-vs-social-welfare/

Posted by: connersooking.blogspot.com

0 Response to "How Much Money Has Been Spent On Welfare Fraud In 2016"

Post a Comment